Not all providers are the same

Wagner understands that change is difficult and it can be nerve racking if you don’t know what the outcome will be. Your company could be looking to outsource for the first time or looking to change providers to find a better fit. Wagner is here to help!

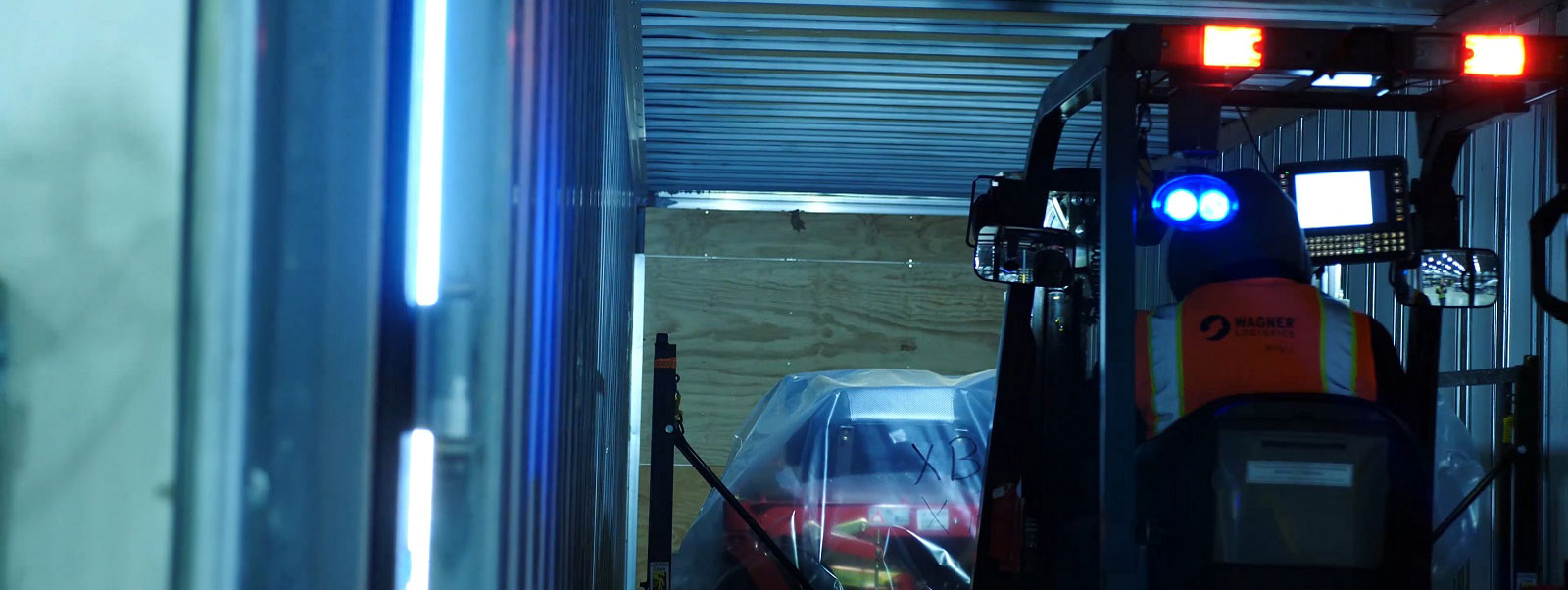

At Wagner we want to be your supply chain partner not just another provider. We will:

Walk you through our quoting process

Provide you a detailed timeline to start

Visibility during each step in the implementation

Scheduled reviews and check in meetings

Our Vision

Our Vision

Wagner has been in operation for over 74 years, working through some of the Nation’s toughest times. We will continue to support your company as we all play a critical role in getting the needed supplies and products to customers across the country and abroad. Our commitment to our customers and family values will continue to guide our operations and policies relating to the COVID-19 Pandemic.

Our vision: Family Values, Exceptional Performance was created from the feeling when you think of family it brings to mind: comfort, belonging, common goals, common values, and commitments to one another. Values have a major influence on our behaviors, attitudes and serve as broad guidelines in all situations. These are the things that we understand as a diverse community of Wagner employees that work in many different locations and that come from many different backgrounds.

It is not by luck that we receive our customers’ highest levels of awards nor is it coincidence that we consistently grow our business with our existing customers. It is because we deliver Exceptional Performance, every day.